All-in-One

Verification

Platform

Welcome to One Click Verify, the all-in-one verification platform that makes it simple for businesses to verify their clients. Our platform has already done the work for you, so all it takes is just one click to start verifying your clients today.

With One Click Verify, you can simply verify your clients’ identity, employment, and other key information quickly and efficiently. No need to visit a physical location or provide extensive documentation – simply create an account with us and follow the straightforward steps to complete the verification process.

Our team of experts will handle the rest, providing you with the verification you need in a timely manner. Trust One Click Verify to provide accurate and reliable verification for your business.

Get started now and streamline your verification process with One Click Verify.

Intuitive Experience

Why it works best

One Click Verify automates the client renewal request upon expiry of photo ID for the life of the User’s subscription.

Saves time, increasing productivity

Everything you need in one place

Delivers client peace of mind never offered before

Our system is updated automatically, making it accessible any time – real time

Biometric Analysis

Security is in our DNA

Utilising the latest technology to deliver true verification of an individual within 1 minute.

One Click Verify is able to reduce identity fraud by 99.9% and meet any KYC/AML requirements.

Results

Fraud eradication

Fail-safe system

Protection

Tax crime, money laundering, cybercrime and identity theft will be a thing of the past

Australian Owned and Certified, no Development or Data is sent offshore – maintaining the highest standards to meet the Australian Privacy Principles

Testimonials

What Our Clients Are Saying

Pricing To Suit Everyone

Pro

An integrated solution for professionals

$0

per month

Free forever

Annual Charge Model on Usage

- Unlimited Clients

- First 10 Clients free

- $5 per Client Verification

- ID maintained annually

- Automated Client Reminders

- Verify Report available to recall ID anytime

- Biometrics Recorded

- Phone and Email Support

- Multi-Factor Authentication

- TFN Check

- PEPs and Sanctions Check

- Additional charge of $20 for PEPs and Sanctions report per client

- Custom Client Email Invitation

- Custom Logo Upload

- Customised User permissions

- Upload Client CSV

- Encrypted and secure transfer to financial institutions

Enterprise

An advanced platform for large organisations with more than 20 Users and verify more than 1000 Clients per annum

Contact Us

Onboarding plus Annual Charge Model on Usage

- Priced per Client

- Volume-Based Pricing

- Dedicated Account Management

- API Integration available

- Migration Assistant

- Fully White Labelled

- Tax Information

- Bank Information

- Credit Information

- Politically Exposed People

- Monitoring

- Maintain KYC Compliance

- Maintain AML Compliance

How it works

Simple to begin

Contact us to create an account and get started verifying within 24 hours.

One Click Verify is Verification of Identity (VOI) that supports the financial services compliance framework of Know Your Client (KYC) using Multi Factor Authorisations (MFA) encompassing five-factor authentication (MFA – 5 or 5FA and similar terms).

One Click Verify is an electronic authentication method to verify a person is who they say they are via a minimum of five factors (identifiers) of which they must have one from each of the following:

Knowledge – something only the user knows such as Tax File Number

Possession – something only the user has, such as identification document(s)

Inherence – something only the user is, such as biometrics

Location – somewhere the user is, such as User Agent and IP

Token – something only the user has access too, such as one time validation code.

Once a client is verified they will be able to get access to the financial service while the subscription is maintained with automated client renewal requests when photo ID expires.

The APPs incorporated in the Act are a single set of principles that apply to both agencies and organisations. These are collectively defined as ‘APP entities’. An entity includes organisations (sole traders, body corporates, partnerships and trusts) that have an annual turn-over of less than $3,000,000.

Thus, compliance with the APPs is required by all private sector organisations that provide financial services under Item 6 and Item 11 outlined under Privacy Regulation 2013.

Item 6

Organisations that provide trustee services.

Item 11

Organisations that provide any of the following:

(a) financial planning services;

(b) financial products and services (including brokers);

(c) insurance products and services;

(d) banking services and loans as a credit union;

(e) subsidised or reduced interest loans.

One Click Verify collects personal information from:

– Persons enquiring or applying for verification

– Government agencies and other organisations seeking information or verification for KYC/AML purposes

– Persons purchasing services from us and from our Users.

Much of this information is collected directly from the client concerned, including through emails, mobile and our web app. We also collect this information from publicly available websites, directories and databases and via social media.

Our website includes a Privacy Statement which deals with issues specific to the collection of information through that site. This Policy should be read in conjunction with such statement.

One Click Verify have a strict agreement with the ATO and part of the operational framework stipulates we do not send any information overseas.

We generally keep personal information active for as long as is reasonably required to enable us to meet the needs of our clients.

We keep identification records and other personal information encrypted on file for up to 3 years, at which point the information is required to be updated again. As part of our data security, we regularly backup and archive our electronic databases.

Please do not hesitate to contact us if you have a concern or issue in relation to how we collect, store, use or disclose personal information.

If your concern relates to your One Click Verify or another One Click Verify function or service please contact us by email to [email protected]

The AML, PEP’s, Sanctions check feature within One Click Verify checks a variety of lists from various governmental and inter-governmental agencies. These lists contain over 366,000 names of known criminals, sanctioned individuals, politically exposed persons (PEPs) and other high-risk individuals and organisations.

A general outline of the data in the lists are provided below.

Politically Exposed Persons lists: These lists contain individuals who are politically engaged in various countries. (e.g Members of the Australian Parliament appear on this list.)

Sanction lists: These lists contain individuals who have been sanctioned by governmental or intergovernmental agencies (i.e the Australians Sanctions Consolidated List). Individuals are usually sanctioned because they are deemed to be involved in illegal activities.

This service matches individuals to the lists by data we know which sometimes may only be name only so it is possible for false positives to occur. For example, someone with a common name like Tony Jack will fail the check due to having the same name as (Tony Jack who is an Australian Councillor) and included on this list.

If a person fails a PEP check it is up to the individual performing the check to decide the best course of action based on the results. It is suggested that a google search be applied, although you can also check the lists we use so you can check their entries in the case of a false positive.

Argentine RePET

Global · Ministry of Justice and Human Rights

Swiss SECO Sanctions/Embargoes

Switzerland · State Secretariat for Economic Affairs (SECO)

Canadian Listed Terrorist Entities

Canada · Public Safety Canada

Kyrgyz National List

Kyrgyzstan · ФИНАНСОВОЙ РАЗВЕДКИ ПРИ ПРАВИТЕЛЬСТВЕ КЫРГЫЗСКОЙ РЕСПУБЛИКИ (ГСФР)

Ukraine SFMS Blacklist

Ukraine · Державна служба фінансового моніторингу України (Держфінмоніторинг)

Rosfinmonitoring WMD-related entities

Russia · Rosfinmonitoring

HMT Consolidated List of Targets

United Kingdom · Office of Financial Sanctions Implementation

Kazakh Terror Financing list

Kazakhstan · Қазақстан Республикасының Қаржылық мониторинг агенттігі

French Freezing of Assets

France · Ministry of Economy, Finance, and Recovery

US Trade Consolidated Screening List (CSL)

United States · Department of the Commerce – International Trade Administration

Japan Economic sanctions and list of eligible people

Japan · Ministry of Finance

EU Financial Sanctions Files (FSF)

European Union · European External Action Service

Ukraine National Security Sanctions

Ukraine · National Security and Defense Council

South African Targeted Financial Sanctions

Global · Financial Intelligence Centre (FIC)

Israel Terrorists Organizations and Unauthorized Associations lists789

Israel · National Bureau for Counter Terror Financing

US OFAC Consolidated (non-SDN) List

United States · Office of Foreign Assets Control (OFAC)

Canadian Special Economic Measures Act Sanctions

Canada · Global Affairs Canada

Australian Sanctions Consolidated List

Australia · Department of Foreign Affairs and Trade (DFAT)

UN Security Council Consolidated Sanctions

Global · United Nations Security Council (UN SC)

US BIS Denied Persons List

United States · Bureau of Industry and Security (BIS)

US OFAC Specially Designated Nationals (SDN) List

United States · Office of Foreign Assets Control (OFAC)

CIA World Leaders

United States · Central Intelligence Agency (CIA)

Members of the European Commitee of the Regions

European Union · European Committee of the Regions

Every Politician

Global · MySociety (UK Citizens Online Democracy)

Members of the European Parliament

European Union · European Parliament

Peppercat Legislators

Global · Peppercat.org

Peppercat World Leaders

Global · Peppercat.org

African Development Bank Debarred Entities

Global · African Development Bank Group

UNOPS Vendor Sanctions

Global · United Nations Office for Project Services (UNOPS)

WorldBank Debarred Providers

Global · World Bank

INTERPOL Red Notices

Global · INTERPOL

Inter-American Development Bank Sanctions991

Global · Inter-American Development Bank

EBRD Ineligible entities

Global · European Bank for Reconstruction and Development

Asian Development Bank Sanctions

Global · Asian Development Bank

UK Companies House Disqualified Directors

United Kingdom · The Insolvency Service

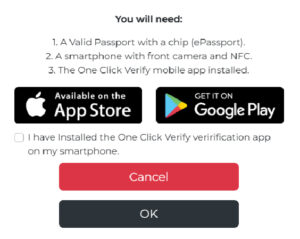

A smartphone is required for this option. You will need to download One Click Verify mobile application onto your smartphone. Once the application has been installed, follow the instructions in the mobile application.

Alternatively, if you have started the registration process on your desktop computer and have installed the One Click Verify mobile application, you may select the box (as demonstrated below) and it will produce a QR code which you scan with your smartphone camera.

You may choose manual verification and enter your passport or driver license information.

Scanning a QR code can be done with most smart devices and the process is a little different depending on your device’s operating system and model.

For iOS devices: Open the default camera app and hold your device so that the QR code appears in the viewfinder in the camera app. Your device will recognise the QR code and display a notification. Tap the notification to open the link associated with the QR code.

For Android devices: Devices running on android 8 or newer OS can scan the QR code with the camera app. Some older devices will require you to download a third-party QR code reader app.

You may request to reset your password at the log in screen.