AML/CTF 2025 – What It Means for Everyday Australians

The Final AML/CTF Rules 2025 were tabled in Parliament on 29 August. Most headlines have focused on banks and financial services, but there’s an important …

oneclickverify

The Final AML/CTF Rules 2025 were tabled in Parliament on 29 August. Most headlines have focused on banks and financial services, but there’s an important …

oneclickverify

Author: Yajush Gupta – August 6, 2025, Dynamic Business New data privacy regulations are landing with tight deadlines, leaving businesses scrambling for practical solutions. While …

oneclickverify

One Click Group’s Nathan Kerr and Zed Law’s Ryan Zahrai explore how identity, compliance, and client experience are being reimagined in real time. Redraft: The …

oneclickverify

ASIC just dropped a hard line—and FIIG’s cyber slip has landed them in a JAM. (Not the good kind with tunes and Friday drinks… we’re …

Nathan Kerr

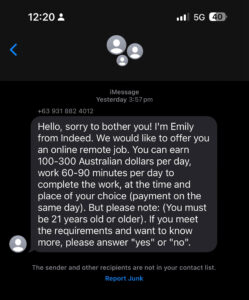

Even the CTO of an AML tech company gets scam texts… Our CTO, Nathan Kerr, got this text message yesterday — claiming to be from …

oneclickverify

Everyone Wants to Use AI — But Most People Are Skipping the One Skill That Actually Matters We’re handing out powerful AI tools like candy …

Nathan Kerr

We trust our systems to verify identity — but sometimes, you still need to go nose-to-nose. We recently opened up two dev roles.Posted on LinkedIn …

oneclickverify

Is your verification provider really worth what you’re paying? Let’s be real — credential stuffing attacks like the one hitting super funds this week don’t …

oneclickverify

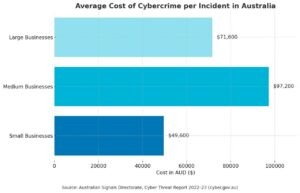

An Observation from Jack Challis, Compliance Director at One Click Group. Managing multiple compliance functions—like the Australian Signal Directorates’ IRAP, Attorney-General audits, the DSP Operational …

Jack Challis

By Nathan Kerr, CTO and Executive Director at One Click Group Limited There really is no sexy answer to this. The best way to protect user data …

oneclickverify