Scam texts: Money Mule Recruitment

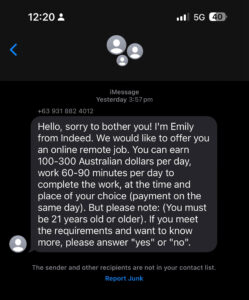

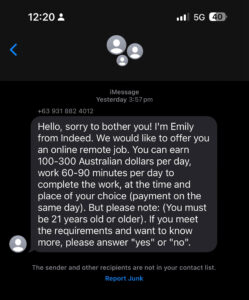

Even the CTO of an AML tech company gets scam texts… Our CTO, Nathan Kerr, got this text message yesterday — claiming to be from …

oneclickverify

Even the CTO of an AML tech company gets scam texts… Our CTO, Nathan Kerr, got this text message yesterday — claiming to be from …

oneclickverify

We trust our systems to verify identity — but sometimes, you still need to go nose-to-nose. We recently opened up two dev roles.Posted on LinkedIn …

oneclickverify

Is your verification provider really worth what you’re paying? Let’s be real — credential stuffing attacks like the one hitting super funds this week don’t …

oneclickverify

By Nathan Kerr, CTO and Executive Director at One Click Group Limited There really is no sexy answer to this. The best way to protect user data …

oneclickverify

With deep fake sextortion and chatbots encouraging youth to commit crimes, AI is quickly becoming even more dangerous for Aussie kids. AUTHOR: Jake Moore Artificial …

oneclickverify

The 2024 federal budget delivered funding to combat scams and online fraud. A new Scams Code Framework will be established with $67.5 million of funding …

oneclickverify

An identity service provider or gateway service provider can assist you in digitally identifying your customers. So how are they different to an identity broker? …

oneclickverify

Identity verification can significantly impact customer acquisition for businesses, especially those in industries that require trust and compliance with regulatory standards, such as financial services, …

oneclickverify

Card Not Present (CNP) fraud refers to fraudulent transactions where a payment card (such as a credit card or debit card) is used for a …

oneclickverify

Money laundering, terrorism financing are significant risks faced by financial services so having a robust Anti-Money Laundering (AML) program in place is crucial. According to …

oneclickverify